Make Use Of the Apple Card for acquisitions immediately with Apple, along with music and also apps, and also with associate merchants the place you can even gain 3% Every day Cash

Apple Credit Card Review

Pros— Apple Credit Card Review

Distinctive benefits for Apple and also partner-merchant acquisitions: Along with the highest possible incomes charge on acquisitions at Apple, you will furthermore get the three% Day after day Cash cost at friends that symbolize Uber, Uber Consumes, Walgreens, Nike, and in-store acquisitions at T-Cell.

Good rewards bill on Apple Pay acquisitions: Seventy-four of the highest 100 retailers within the UNITED STATES choose Apple Pay and continues so regarding add buddies. The business in addition states 65% of all retail locations within the country help the contactless deal style ,3 so in case you save at any of these areas, you have actually obtained a wonderful alternative to generate rewards. The cardboard‘s rewards charge on Apple Pay acquisitions gets on par with and also typically higher than the excellent flat-rate incentives playing cards offered on the market.

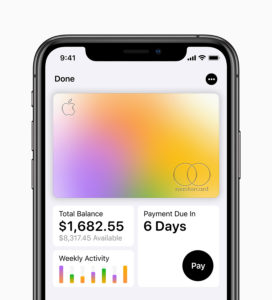

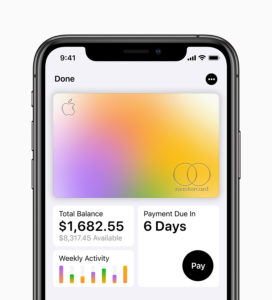

Monetary-management instruments: Apple brings its trademark style needs to a product that lacks visible pleasure— charge card declarations. The interactive alternatives supply a new choice to regard charge card inquisitiveness and also the way your price behaviors have an result on it.

Low coating of APR vary is among the many finest: If you occur to can qualify for it, the Apple Card APR lacks uncertainty among the most affordable on the market, especially when it come to benefits playing cards. The excessive coating of the differ is comparatively reduced, also, however you remain to don’t need to obtain captured paying that charge.

Disadvantages— Apple Credit Card Review

Solely cost it for Apple clients: The cardboard‘s well worth comes from Apple Pay, which you‘ll be able to‘ t usage with out an Apple gadget.

Mediocre benefits charge on non-Apple as well as non-Apple Pay purchases: The physical Apple Card may look great, nevertheless there‘s no reason to hold it with you when you‘re open to having multiple bank card. Playing cards similar to the Capital One Quicksilver or Chase Flexibility Limitless supply a higher incentives charge on all acquisitions.

Couple of advantages: As a monetary gadget, this card pays for little past the rewards on Apple acquisitions and also Apple Pay. When you remain in search of a sign-up benefit or alternatives like a complimentary credit history rating or rental auto insurance policy protection, this isn’t the cardboard for you.

Does not get in touch with budgeting apps: When you use a third-party application to keep observe of your bills, it will certainly not be capable of ingest your Apple Card investing .4.

Incomes Variables & Benefits.

The Apple Card manages what it calls Daily Cash, its personal design of cash-back incentives. Cardholders make 3% Every day Money on Apple acquisitions, 2% on acquisitions made with Apple Pay, and also 1% on acquisitions made at merchants that do not go for Apple Pay. (The bodily card, like many playing cards opting for a high-end appearance, is produced from steel— on this case, titanium.).

Apple additionally has a number of associate stores the location cardholders can get 3% Each day Money when using Apple Pay, along with Uber, Uber Eats, Walgreens, Nike, and T-Cell (in-store acquisitions only) .2.

Apple Card doesn’t restrict the quantity of Every day Cash you potentially can earn, as well as Every day Cash doesn’t end. When you have actually obtained unredeemed Each day Cash if and once you shut the account, Goldman Sachs will certainly both credit rating it to your account, ship it to you digitally, or mail you a check out .5.

Compensatory Benefits.

Daily Money regularly builds up in your Apple Cash card, which you‘ll be able to after that make use of on something that you merely spend for with Apple Pay. Clients with out an Apple Money account can redeem Each day Cash as a news release credit score .5.

Properly to Get the Most Out of This Card.

Make Use Of the Apple Card for purchases right away with Apple, along with songs as well as applications, and also with associate sellers the location you can also earn 3% Daily Money. Needless to say when you acquire Apple product by one other seller, even one accredited to advertise Apple product, the three% charge does not apply. Aside from that, utilize it at retailers that choose Apple Pay, other than you might have a incentives card that makes a much better fee at that sort of vendor. For example, if in case you have a card that supplies you greater than 2 factors per $1 invested in recreation, also when the flick show you go to accepts Apple Pay, use the contrary card to purchase your tickets.

Take full advantage of benefits by retrieving Each day Money as a news release credit history. Utilizing Every day Cash via Apple Money implies you‘re not earnings benefits on these acquisitions, when you potentially can get 2% once again using Apple Card with Apple Pay.

Apple Card‘s Various Alternatives— Apple Credit Card Review.

Budgeting instruments.

Charge card financial obligation gadget that displays how the quantity you pay on a monthly basis affects the amount of curiosity you owe.

Customer Competence.

Apple Card is Goldman Sachs‘ initial bank card, to make sure that is unidentified region, as well as the buyer experience remains to be seen. On a positive observe, you perhaps can ask for assist and acquire assist via textual content, although it‘s vague if this solution is accessible 24/7. The Apple Card doesn’t provide a cost-free credit report rating, not like the majority of its major competitors.

Safety Options.

Quantity-less charge card: Each the bodily as well as digital Apple Playing cards don’t have any kind of numbers on them. For non-Apple Pay deals on apps or website needing a card, the Pockets app or Safari web web browser autofills a digital card quantity.

Built-in map expertise: Faucet a transaction you do not acknowledge to yank it up in Maps and also see the area it occurred.

Charges.

Apple Card has just a couple of costs, partially as a result of it does not supply concerns like cash advances or steadiness transfers. Late or missed out on funds do not lug a price nevertheless will cause extra curiosity accruing in your steadiness. Merchants in loads of countries choose Apple Pay ,6 so when you uncover Apple Pay acceptance overseas, you‘ll be cheerful to understand the Apple Card doesn’t set you back a overseas transaction cost.

Source: Apple